You probably heard about the several stock market crashes that happened in history. Sometimes it’s about houses, the other time it’s about Bitcoin. But did you know that there was also a Dutch tulip bubble where a flower caused an economic crash and put a lot of people in poverty?

In this article, I want to explain the 17th century Dutch tulip mania. Interested in this tulip craze? Then be sure to read this blog post.

What was the Dutch tulip mania bubble?

This whole financial bubble started with a tulip craze that led up to a lot of speculation and ended with a tulip crash. This happened in the 17th century, the Golden Age, in the provinces that are now part of the European country the Netherlands.

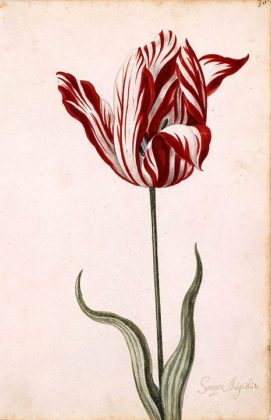

Tulip bulbs, the source of which the tulip flowers grow, were the talk of the town in the 1600’s. Particular in the provinces of Holland and Utrecht. Even now, the flower is still the symbol of the Netherlands. In short: the prices of the tulip bulbs grew extremely rapidly to heights that were only possible because of price speculation. Especially the Semper August tulip bulb, a flower that was red and white coloured, was popular. But in 1637, a stock market crash caused a crisis in prices which made a lot of people lose their invested money.

This tulip stock market crash is comparable to the economical crisis we sometimes see at Wall Street and even with the Bitcoin crypto market crashes.

How did the tulip fever start?

The flower originated in the former Ottoman Empire in the Middle-East. In the 16th century, it was introduced by trade in Europe. And it didn’t take long for the tulip craze to begin.

It became an important part of economics and trade at already the end of that 16th century. At that point, the flower was rare in western Europe. Especially colourful variations of the tulip were rare and therefore created a big market.

A tulip fever and tulip mania

So the trade in tulip bulbs grew. The flower became very popular. The variations of the tulip flower became collector’s items for which collectors, and everybody who could afford it, would pay big money. You can speak of a real tulip fever and people were so eager to have the flowers you can even call it a tulip mania.

The fact that it was a real mania was also bad news for the trade of the flower bulbs. At the start of the 17th century, the price of a tulip bulb could go up to 1.000 Gulden, the Dutch currency in those times. An average yearly income was 150 Gulden, so it’s clear that the tulip mania was growing to its peak.

An example of the tulip mania: the Semper Augustus flower

The most known example of the tulip mania was the tulip variation called the Semper Augustus tulip , a red and white variant depicted in the picture beneath. A buyer once paid the price of 6.000 Gulden. This was in the 17th century the price of a very nice house in Amsterdam!

The tulip crisis: an economic bubble

This tulip fever and mania transformed into an economic bubble. This was the result of heavy speculation. Let me explain to you how this speculation created the bubble:

Normally, people would buy tulip bulbs in the months april and may. At that point, they could see the flower in full growth. Later, in the summer when the flower stopped blooming, they would get the bulb of which they saw the tulip it produced a couple of months before.

But now, in the 16-17th century, people would already pay high prices for tulip bulbs of which they never saw the flower it produces. So it was a bit of a gamble. Also the traders were speculating. They sold tulip bulbs without having them in stock. And of course, there were also collectors who put in a bid without not having the money at that time. People also put in a bid for a tulip bulb, to already sell it for a higher price to the next interested person. This chain of events caused a lot of people to put a lot of their money in the tulip trade. But it was a fragile bulb that would cause a lot of people to lose their savings.

Of course, a crisis was inevitable. Suppliers couldn’t supply anymore, a lot of buyers couldn’t pay their bills anymore. The hype also started to die out, which made the prices plummet. The tulip mania bubble collapsed and a crisis was created.

But, was there really an economical tulip crisis?

The tulip mania is a famous event that still triggers our fantasy. It’s not remarkable that we even saw a movie about it (you can read my review of this movie Tulip Fever here). But recent historical research suggests that maybe this crisis wasn’t that bad as we think it was.

Was it all an effect of the rise of people’s wages? Or was it the government and her laws that lead to speculation? A lot of comparisons are made with the whole crypto world and especially with Bitcoin. There are not a lot of rules surrounding investing in crypto coins and bonuses with New Year or Thanksgiving also makes price peaks possible. The pandemic Covid-19 crisis also stimulated the belief, and therefore price surges, of crypto coins.

Not the only economic bubble and crisis in history

The tulip fever that caused an economic bubble and crisis was certainly not the only one in our history. Remember the Wall Street Crash of 1929 or the dot.com bubble of 1990.

Sources

Wikipedia

Investopedia

Pictures: Wikpedia & Pexels